This will be a relatively short review of the UK Dividend Stocks Portfolio because I only published the (slightly late) half-year review a few weeks ago.

I'll begin with a little context.

Things have not been going well for the UK economy

I'm not going to re-hash all the details of the Bank of England's intervention in bond markets, because you've probably heard it all before. If you haven't, you can find good summary of the near-disaster on the Monevator blog.

More importantly, I don't think a detailed understanding of short-term economic ups and downs is very useful for long-term dividend investors. If you're a long-term dividend investor, you should be thinking about how your dividend income might grow over the next five or ten years, not the next five or ten months.

Instead of trying to predict an unpredictable short-term future, I think most dividend investors should invest defensively so that their portfolios and their dividend income are relatively well-insulated from economic downturns.

In my case, this means:

- Don't invest more than 10% of the portfolio into any one stock

- Don't have more than three (out of about 20) holdings from one industry

- Don't invest more than 50% of the portfolio in one country

- Do invest at least 50% of the portfolio into defensive stocks

- Don't invest in highly cyclical stocks (miners, oil & gas, housebuilders, etc)

- Don't invest in fragile businesses (low profitability, high debts, no competitive advantages)

These risk-reduction policies are always in place, so even though we are clearly on the brink of a severe economic slowdown, I won't be making any significant changes to my portfolio.

Dividends are still rising, despite the economic doom and gloom

As an investor, it's important to know what your long-term goals are so you can focus on things that are relevant to your goals while ignoring those that aren't.

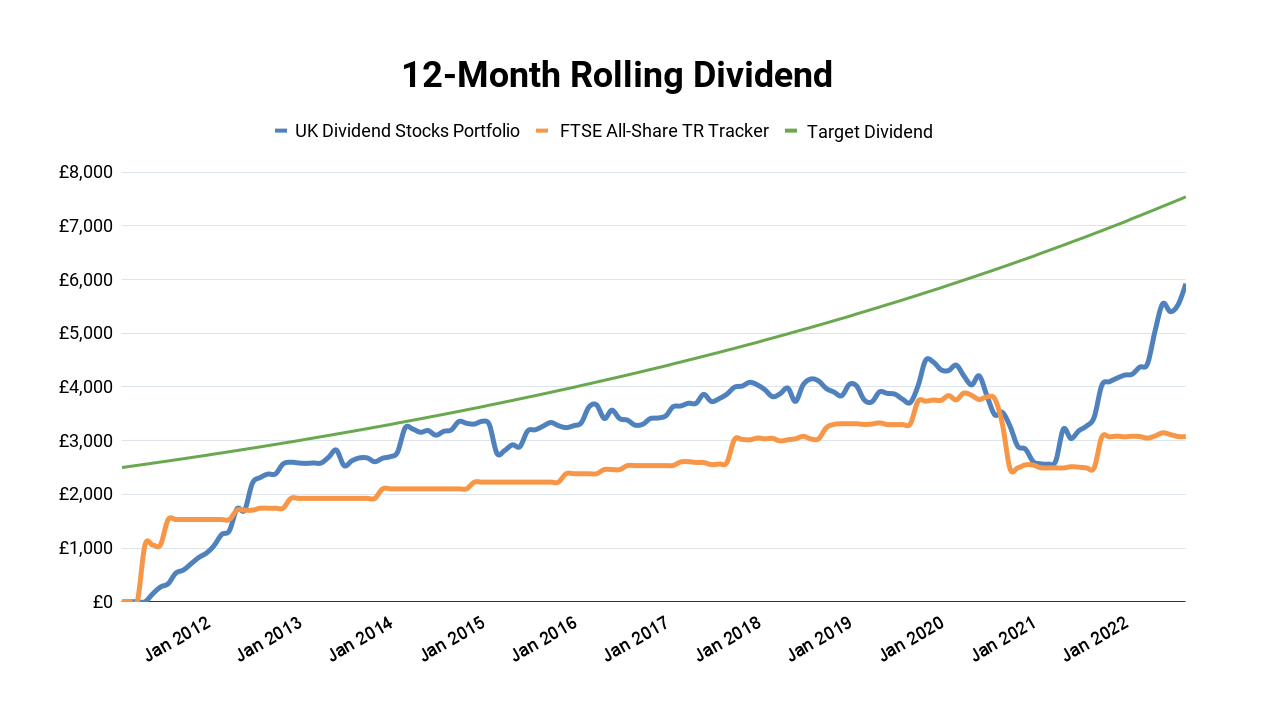

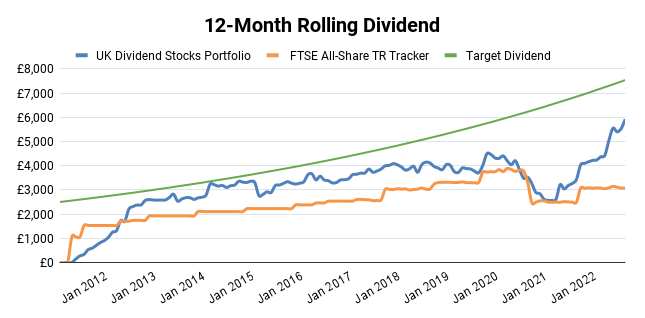

I'm a dividend investor, so the most important thing for me is that my portfolio's dividend is going up over time. More specifically, my target is a dividend yield of 5% combined with an organic dividend growth rate of 5%. The portfolio's dividends are reinvested, which means the overall dividend should be going up by 10% per year on average.

Here's a chart showing how the portfolio's rolling 12-month dividend has grown since inception in 2011.

Despite all the economic doom and gloom, the portfolio's dividend is still recovering strongly post-pandemic. In fact, the portfolio's 12-month rolling dividend is now almost twice that of its Vanguard FTSE All-Share tracker benchmark, which is a major milestone.

Of course, dividends are not guaranteed and perhaps there will be some dividend cuts in 2023, but so far at least, none of the portfolio's holdings have reported any major problems.

Dividend yields are into double-digits

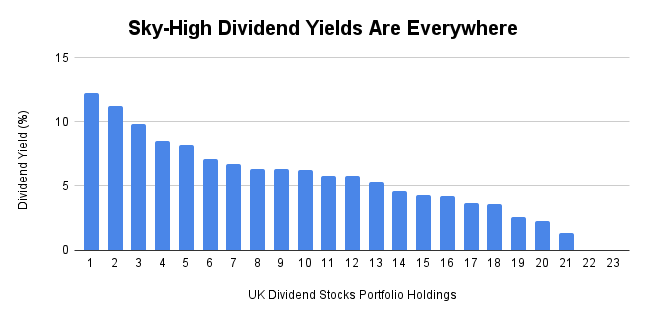

While some investors weep because share prices are going down, dividend investors can rejoice because yields are going up. Here's a chart showing dividend yields for all of the portfolio's 23 holdings.

Currently, there are two holdings with double-digit yields. Usually that's a big red flag, but not always.

For example, Legal & General (which is in the portfolio) had a dividend yield close to or above 10% for much of 2020, even though management said (and subsequent performance confirmed) that the pandemic was, if anything, a tailwind for its core pensions business.

If the market was wrong to offer L&G with a double-digit yield in 2020, it could be wrong again today. More generally, I think investors should be wary of automatically dismissing stocks with yields of more than 5% or even 10%, especially given the current level of negative sentiment in the UK market.

The chart above also shows that two holdings have yet to reinstate their dividends after suspending them during the pandemic. Perhaps unsurprisingly, both companies are heavily exposed to the aerospace industry where the impact of covid was extreme.

I don't like to sell companies just because they temporarily suspend their dividends, especially given the very unusual circumstances caused by the pandemic. However, these companies do need to reinstate their dividends fairly soon, otherwise they'll be on the chopping block.

Looking at the portfolio's overall dividend yield, it is now comfortably above my 5% target.

The last time the portfolio's yield reached 6% it didn't last long because the pandemic caused an unprecedented number of companies to cut or suspend their dividends.

But if history tells us anything, it's that the upcoming recession is likely to be nowhere near as bad as the pandemic, where the economy was almost completely closed for months on end. My guess is that far fewer companies will cut or suspend dividends this time around but, as always, we shall have to wait and see.

Long-term investors should see falling share prices as an opportunity

With dividend yields so high, it should come as no surprise that share prices are low. Here's how falling share prices have affected the portfolio's market value.

The portfolio's market value is down about 16% in 2022 and, from the point of view of a long-term investor (I intend to run this portfolio until at least 2041), that's good news.

It's good news because I can use the portfolio's dividends to buy shares in new or existing holdings at valuations that appear, at least to me, to be very attractive.

And when we come out the other side of this recession, as we almost inevitably will, I think the UK market is likely to recover strongly, just as it did after the 2000-2003 crash, just as it did after the 2009 crash and just as it did after the 2020 crash.

Warren Buffett says investors should be fearful when others are greedy, and greedy when others are fearful, and that's why I'm putting money into this market rather than taking it out.

Building a more defensive dividend portfolio

I mentioned earlier that two of my rules are to not have more than 50% of the portfolio invested in the UK or in cyclical stocks.

I must confess that I'm currently breaking both rules, with 56% of the portfolio's total revenues currently generated in the UK and 53% of the portfolio invested in cyclical stocks.

As a first step towards fixing this, I have just added a global pharmaceutical stock to the portfolio. It has very little exposure to the UK and it operates in the defensive pharmaceutical sector, so although it won't fix these issues immediately, it's a step in the right direction.

With a few minor adjustments to position sizes, I should be able to get the portfolio's weightings towards the UK and cyclical stocks below 50% by the end of this year.

And speaking of position sizes and cyclicality, here's a chart showing position sizes for all current holdings (now 24 holdings including the new pharma company) and their cyclicality.

The largest positions tend to be in defensive companies and that's deliberate. I use a slightly larger default position size for defensive stocks versus cyclical stocks (4% versus 3%), and I then adjust each position based on valuation metrics (the more attractive the valuation, the larger the position size).

Building a more concentrated portfolio

Continuing on the theme of position sizes, I'm still in the process of reducing my holdings to 20 or less. This should both improve performance and reduce the effort required to run the portfolio.

It should improve performance because having fewer holdings will allow me to invest more money into the portfolio's most attractive holdings, although without going over my 10% position size limit.

it should also improve performance because having fewer holdings will allow me to invest more time into researching each holding, hopefully leading to better insights into their future prospects and dividend-paying potential.

My goal for 2022 was to get the portfolio below 25 holdings (down from 35 in 2020), so that goal is already in the bag. My goal for 2023 is to get the number of holdings into the 15 to 20 range, at which point I think it will be concentrated enough.

Looking ahead to Q4

The last quarter of 2022 is definitely going to be "interesting" and, for many people, probably quite unpleasant.

There could well be a steady flow of very negative economic news, especially from the UK housing market which, I think, could be about to run into a brick wall with average two and five-year fixed mortgage rates above 6%.

As usual, I'll be doing a UK housing market review at the beginning of 2023, along with year-end reviews of the FTSE 100, FTSE 250 and S&P 500.

And finally, please remember that long-term investors need to stay focused on the long-term prospects of their investments, especially when the media is whipping itself into a frenzy of negativity.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.