Another year has whizzed by and so, inevitably, it’s time for investors up and down the land to review their portfolio’s performance over the last 12 months and beyond.

In my case, I’m going to review the UK Dividend Stocks Model Portfolio, which I set up in 2011.

It's a virtual portfolio that I manage using ShareScope’s portfolio tool and it holds exactly the same stocks as my real-world portfolio, with approximately the same position sizes.

This is, somewhat obviously, a dividend-focused portfolio, so it invests in a diverse basket of 20-30 quality UK dividend stocks that I think are trading at a material discount to fair value.

The portfolio reinvests all dividends and is benchmarked against the Vanguard All-Share Unit Trust (accumulation), which tracks the FTSE All-Share. Both portfolios were launched with 50,000 virtual pounds in March 2011.

Table of Contents

- Performance goals

- Income: Dividend yield is fractionally ahead of the All-Share

- Dividend Growth: Dividends have returned to growth

- Capital Growth: Ten-year returns come close to my 10% target

- Risk: Volatility wasn’t an issue in 2021

- Tweaking my investment strategy to improve returns and reduce risk

- Lots of holdings were sold in 2021

- Looking ahead to 2022 and beyond

Performance goals

I like to start my annual reviews with a recap of what I’m trying to achieve as an investor, so here are my main goals:

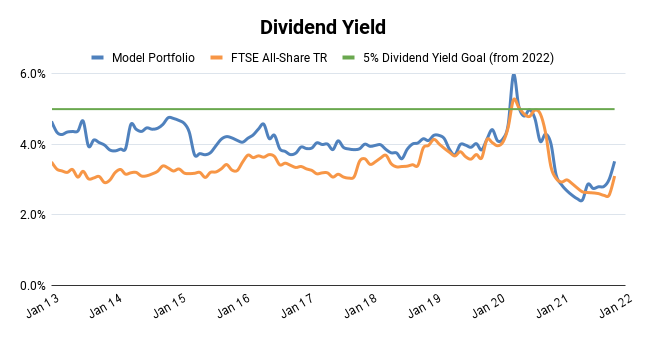

Income: As a dividend investor my primary goal is to generate a robust and growing stream of dividends. More specifically, I want my portfolio to have a higher dividend yield than the FTSE All-Share and preferably a yield of more than 5%.

Aiming for an attractive dividend yield is an obvious goal for a dividend investor, but it’s also a good idea to measure growth.

Growth: One simple way to measure growth is to track your portfolio’s total return, which is dividend income plus capital gains.

In my case, I’m looking to beat the FTSE All-Share on a total return basis. Since performance over one day, week, month or year is largely down to luck, I focus on beating the All-Share over five years, ten years and longer. In addition, I would ideally like annualised total returns of at least 10% over the long term.

Risk: I don’t want to have a heart attack because my portfolio declined by 90% in a year, so I have another rule which is that my portfolio should be less volatile than the FTSE All-Share. This can be hard to achieve as I have no control over share price volatility, but I still think this is a goal worth striving for.

Okay, those are my goals. Let’s have a look at how my portfolio and its All-Share benchmark performed in 2021.

Income: Dividend yield is fractionally ahead of the All-Share

Today the portfolio’s dividend yield is slightly ahead of its All-Share benchmark, at 3.6% versus 3.0%.

That’s some way behind my 5% yield goal, so of course, I have a list of excuses to explain that:

-

I only started using a 5% yield goal quite recently, so I've only focused on achieving that level of yield in recent months and those higher dividends will take quite a bit of time to flow through.

-

We’re in the middle of a pandemic, so it’s entirely reasonable for dividends to be abnormally low following a broad swathe of dividend cuts and suspensions.

With the pandemic (hopefully) on the way out and my portfolio tilted much more towards high-yield stocks than it was a year ago, I expect to hit that 5% yield target at some point in 2022.

Dividend Growth: Dividends have returned to growth

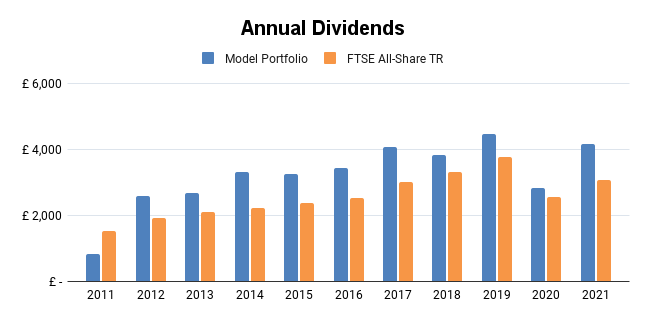

2020 was not a great year for dividends, but fortunately, the decline in income was relatively short-lived.

The FTSE All-Share’s dividend recovered through 2021, ending the year just 18% down on its 2019 high.

My model portfolio did slightly better, recovering more strongly to end the year just 7% below its 2019 high.

The model portfolio's more abrupt turnaround in dividends is mostly due to the fact that I’ve tilted it towards higher quality and higher yield holdings, and I’ll explain that in a bit more detail shortly.

Capital Growth: Ten-year returns come close to my 10% target

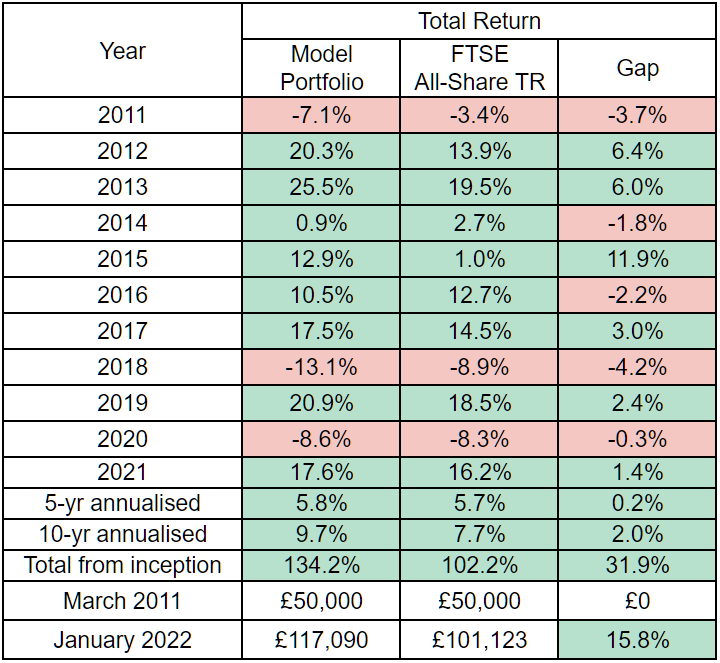

The portfolio produced total returns of 17.6% in 2021 which is well ahead of my 10% target. This was of course mostly due to the FTSE All-Share’s similarly impressive 16.2% gain.

However, as I’ve already mentioned, short-term returns are dictated almost entirely by the market’s random walk, so don’t beat yourself up if you didn’t achieve 17% returns, and don’t pat yourself on the back too much if you got a lot more than that.

Returns over the long term are what really matter, and on that front, I’m reasonably happy with the portfolio’s 9.7% annualised return over the last decade. 9.7% is ahead of the All-Share by 2% per year and only fractionally behind my 10% target.

Overall, I'm reasonably satisfied with the portfolio's performance over the last decade. Over those ten years, I've learned a great deal about investing and, hopefully, that should translate into even better returns over the next ten years.

Risk: Volatility wasn’t an issue in 2021

Measuring volatility in an up year is kind of pointless as most investors are happy to see share prices going up. What matters in terms of volatility is whether a short-term drop in share prices is enough to make me lose sleep or give me an ulcer.

In 2021 there were no major declines, so ulcer-inducing volatility wasn’t an issue.

Having said that, historically the portfolio has underperformed the All-Share in down years, and that’s something I’ve tried to fix this year by tilting the portfolio towards higher-quality companies. Unfortunately, there’s no way to know if that’s worked until we hit the next major correction or bear market.

Tweaking my investment strategy to improve returns and reduce risk

In the January 2021 issue of the UK Dividend Stocks Newsletter I said:

“2020 has been a year to forget for many reasons, but I don’t want to forget the investment lessons this difficult year has provided. For me, there were two main lessons, both of which are interrelated:

(1) Quality companies purchased at sensible prices tend to outperform

Having spent quite a bit of time developing my new Quality Defensive Value framework, I decided to look back at every model portfolio holding since it was launched in 2011. Perhaps unsurprisingly, most of the best performers met the criteria for quality, while most of the worst performers did not.

To capture more of these ‘quality’ returns I will be more even selective in terms of the companies allowed within the model portfolio. This will involve reducing the number of holdings from 34 today to around 20-25, mostly by removing lower-quality holdings.

(2) Actively managed portfolios should be tilted towards their most attractive holdings

I’m going to begin actively managing the model portfolio’s position sizes by trimming holdings that are too large given their attractiveness and topping up holdings that are too small given their attractiveness.

In other words, the size of a position should roughly match the attractiveness of the holding.”

I stuck to this plan through 2021 and by the end of the year, the portfolio had reduced from 34 holdings to 27.

I also started calculating a Target Position Size for every holding based on their Quality, Defensiveness and Valuation. The calculation starts out with a default size which is then adjusted based on the company's Margin of Safety, which is basically the gap between the current share price and my estimate of fair value.

In practice it works like this:

- Quality Cyclicals have a default position size of 3%

- Quality Defensives have a default size of 4%

- If a stock’s Margin of Safety is zero then it's trading at fair value, in which case the target size will be 50% of the default size (e.g. 2% for a Quality Defensive)

- If a stock’s Margin of Safety is 100% then it's trading at my target purchase price, in which case the target size will be 150% of the default size (e.g. 6% for a Quality Defensive)

If any of the holdings drift more than two percentage points from their target size, I’ll trim or top them up, but only once per month and only if the resulting trade is more than £1,000 (to keep trading fees to a sensible level).

If you want to know the gritty details of how this target size is calculated, take a look at my investment spreadsheet.

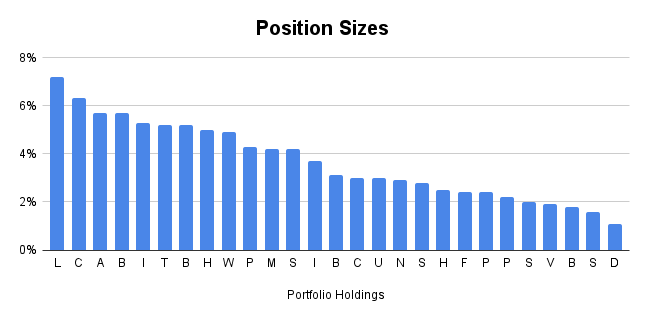

After a year of making these adjustments, my portfolio is now slimmer and more heavily invested in its most attractive holdings. The top ten holdings have gone from 43% of the total value a year ago to 55% today, and the largest position has grown from 5.1% to 7.2%.

In theory, this could make the portfolio somewhat riskier, but in practice, the portfolio is now centred around a group of higher-quality companies, so it may actually be less risky than before.

Here’s a quick snapshot of each holding’s position size at the time of writing.

Lots of holdings were sold in 2021

With the number of holdings declining from 34 to 27, there were obviously quite a few sales last year, most of which were lower-quality holdings that didn’t meet my updated quality criteria.

Here's a quick review of each sale and links to much more detailed reviews which were originally published in the UK Dividend Stocks Newsletter.

January - Sold Hyve Group for a total return of minus 52%

This corporate events business was struggling even before the pandemic appeared. When I re-reviewed the business in light of my shift towards higher-quality companies, it didn’t make the cut.

February - Sold N Brown for a total return of minus 63%

I bought N Brown in 2014 because it looked cheap, but really it was facing huge challenges in converting from a mail-order catalogue business to an online-first business. This was another investment that failed to meet my new standards for quality.

March - Sold Mitie for a total return of minus 32%

Mitie had serious structural issues thanks to its long history of growth by acquisition. I sold Mitie partly because it didn’t meet my updated quality criteria and partly because it made another huge acquisition when it purchased Interserve’s facilities management business.

April - Sold Standard Life Aberdeen for a total return of 17%

This company originally joined the model portfolio in 2016 as Aberdeen Asset Management, before the merger with Standard Life. As a more experienced investor, I now think both companies lack durable competitive advantages and I think that’s true of the combined business as well (note that this company is now inexplicably called abrdn).

May - Sold Petrofac for a total return of minus 74%

When Petrofac joined the model portfolio in early 2014, its earnings had grown by 35% per year over the previous ten years and its average return on capital (ROCE) was 30%. When oil and gas supply finally caught up with demand, prices fell and Petrofac’s construction project pipeline dried up.

Petrofac has struggled to recover ever since and this highly cyclical company was eventually sold as it failed to meet my updated standards for quality and defensiveness.

June - Sold XP Power for a total return of 130%

XP is a global leader in power converters, with the largest technical salesforce and the broadest and most up-to-date range in the industry. I still very much like XP, but its share price increased to the point where the valuation was no longer attractive. I would be happy to reinvest at the right price.

August - Sold Burberry for a total return of 51%

Burberry performed more or less as I expected, with relatively steady growth underpinning its progressive dividend. This made investors happy but it also drove the share price up. That higher price made Burberry less attractive, giving it a miserly 2% dividend yield which is well below the 5% yield I’m looking for. Burberry now sits on my watchlist in case the price falls back to more attractive levels.

September - Sold PayPoint for a total return of 8%

PayPoint’s core market, which is processing utility bill payments paid in cash at local convenience stores, is in long-term decline. When I invested in 2017 I was more forgiving and was willing to invest in turnarounds. But much has changed since then and I am now very reluctant to invest in companies where the core market is in decline.

November - Sold SThree for a total return of 147%

SThree is the world’s only global pure-play STEM (science, tech, engineering, maths) specialist recruitment firm. The pandemic proved to be something of a tailwind and the company performed well in 2020 and 2021, sending the share price soaring. This made the valuation less attractive, so I sold up and reinvested the proceeds elsewhere. SThree now sits on my watchlist.

I would urge you to read through some of those sale reviews as many of them contain useful real-world lessons. A good rule of thumb is that the worst investments contain the best lessons, although reading the SThree and XP Power reviews should also be useful.

Looking at the size of some of the losses from those sales it seems as if 2021 was a terrible year, but as I’ve already said, the portfolio was up 17% and it returned almost 10% annualised over the last ten years.

I think that shows that (a) you have to expect the occasional fairly big loss (big in terms of the position, but not big in terms of the overall portfolio) and (b) a year isn’t necessarily bad just because some of your stocks performed badly.

Looking ahead to 2022 and beyond

In terms of performance, my goals remain the same.

I’d like the portfolio's annualised total returns to nudge above 10%, I’d like the dividend yield to increase to 5% and I’d like the portfolio to get back on track towards my very long-term goal of growing it to £1 million by the end of 2040 (which requires an annualised total return of 10%).

In terms of portfolio management, I want to reduce the number of holdings to between 20 and 25 by the end of this year. I think that will give me the right balance of concentration and diversity.

In terms of my investment process, I don't have any plans to change anything. Mostly I just want to bed in the changes I made in 2021, which were to invest in higher-quality companies and to actively manage position sizes based on each holding’s quality, defensiveness and valuation.

Most of all, I’m looking forward to seeing how the portfolio does over the next year or so, now that it’s more focused on higher-quality companies.

And while the macroeconomic situation doesn’t look great, I’m mildly optimistic about UK stocks over the next decade given their generally low valuations, especially relative to overvalued US stocks.

Happy New Year

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.