Welcome to the Autumn 2023 update of my top UK dividend stocks list.

Before we get to the list of stocks, I just want to point out a couple of things that you (assuming you're a UK dividend investor) are probably already aware of.

UK dividend yields are unusually high

The UK is doomed, we're a pariah and the economy will never recover. At least, that seems to be the narrative among those investors who have abandoned the UK stock market for the glamour (and low yields) of the US market.

This aversion to UK stocks has pushed UK share prices down, which makes investors sad, but it has also pushed dividend yields up, which should make income investors rejoice.

The FTSE 250, for example, is having an especially torrid time at the moment and is about flat over one year, three years and five years (it's actually down about 10% over five years).

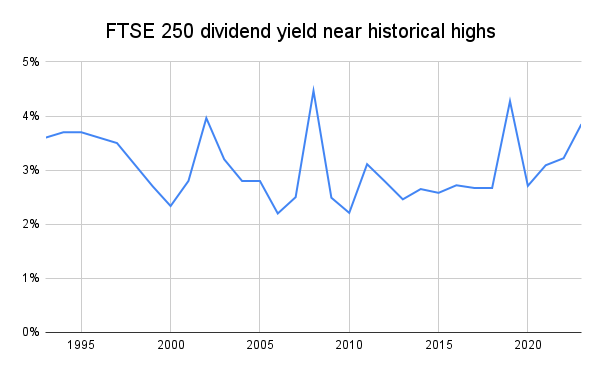

This has made investing in the UK something of an unpleasant slog in recent years. However, just look at the impact that's had on the overall dividend yield of UK mid-cap stocks.

The FTSE 250's dividend yield at the beginning of October was 3.9%. That's comfortably above the long-term average of 3% and it's about as high as the index's dividend yield ever gets (other than in the depths of the 2008-2009 crash).

This is good news because, despite its simplicity, dividend yield is actually a fairly reliable indicator of value and future returns. In other words, when dividend yields are high, expected future returns are also high.

For example, in the chart above, you can see that dividend yields were high in the early 1990s, 2002, 2008 and 2020. Investors who focused on share prices were depressed because prices were falling, but investors who focused on dividend yields were happy because yields were rising.

The yield-focused investors were right to be happy because in each case, the stock market did produce excellent returns over the next few years.

Whether that will happen this time around is impossible to know, but history suggests that this should be a good time to buy UK stocks.

Dividend yields for some individual UK stocks are through the roof

While the FTSE 250's 3.9% dividend yield is historically impressive, there are far higher yields available across a wide range of individual stocks.

For example, the average dividend yield across this top 40 list of relatively large, high-yield stocks is 6.5%. The average yield across the top 10 stocks is 8.6%. If that isn't high-yield then I don't know what is.

Of course, there is an elevated risk of dividend cuts and suspensions when yields are so high, but in many cases, that seems unlikely.

Although Vodafone seems like a basket case, other stocks like British American Tobacco and Legal & General (both of which are in the UK Dividend Stocks Portfolio and my personal portfolio) seem to be well-placed to maintain and even grow their dividends (although, of course, no dividend is ever guaranteed).

Overall, I would say that the UK does offer rich pickings to dividend investors, and on that note, you'll find the full top 40 list of UK dividend stocks below.

You can also download a PDF version of this list, and if you're reading this after October 2023, you can see the current list on the Top UK Dividend Stocks page.

Keep an eye out for the next update, which will be in January.

Disclosure: British American Tobacco, Legal & General, WPP, Unilever, Schroders and ITV are in the UK Dividend Stocks Portfolio and my personal portfolio.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.