Over the last few years, Vodafone’s share price has fallen from 240p in 2018 to about 75p today. At the same time, its dividend yield has risen to the point where it recently crept above 10%.

That’s enough to catch the attention of even the most cautious dividend investor, and it was enough to propel Vodafone to number four on my list of high-yield blue-chip UK stocks.

While Vodafone's high dividend yield is there for all to see, what we don’t know is whether or not that dividend is sustainable. Fundamentally, this is a question about whether or not Vodafone is a quality dividend stock, so that’s the question I'll try to answer in this post.

Note: Just in case you’re not familiar with Vodafone, it’s a FTSE 100 company, it's Europe’s largest mobile network operator, it has a significant footprint in Africa and it also provides a wide range of telecoms-related solutions for businesses, covering everything from cloud computing to the Internet of Things.

Table of contents

- Vodafone’s dividend hasn’t been supported by consistent profits

- Recent losses have largely been caused by past acquisitions

- Adjusted earnings have failed to cover Vodafone's dividend

- Vodafone has failed to grow its dividend over the last ten years

- Profitability is shockingly weak

- Telecoms is a heavily commoditised industry with huge sunk costs

- Vodafone is extremely capital intensive

- Vodafone's debts are eye-wateringly high

- Is Vodafone a quality dividend stock?

- Are Vodafone's shares cheap or expensive at 75p?

Vodafone’s dividend hasn’t been supported by consistent profits

Related: How to find quality companies with consistent profits and dividends

One of the first rules of dividend investing is that a quality dividend stock should consistently generate profits that are both positive and larger than the dividend. Here are two rules of thumb that I like to use:

- Rule of thumb: Only invest in a company if it made a profit in every one of the last ten years

- Rule of thumb: Only invest in a company if total earnings over the last ten years exceeded total dividends

Unfortunately, Vodafone stumbles at the first hurdle in its quest to become a quality dividend stock, because it fails both of these tests.

Data source: SharePad

It made a loss in four of the last ten years and its ten-year dividend cover (including cash returned to shareholders through share buybacks) comes in at just 0.4. In other words, Vodafone paid out more in dividends than it made in profit, which means the current dividend is probably unsustainable unless the company can significantly improve its earnings.

This is very clearly a Red Flag that requires further investigation. The first step in that investigation is to ask why Vodafone has repeatedly posted losses, and then we can hopefully draw some more meaningful conclusions.

Recent losses have largely been caused by past acquisitions

To understand Vodafone's losses in more detail, let’s take a look at each profitless year in turn.

- 2016 (£3.8 billion loss): This loss can mostly be attributed to a £0.5 billion goodwill impairment in Vodafone Romania and a £3.2 billion reduction in deferred tax assets relating to Vodafone's business in Luxembourg. In both cases, these costs were related to previous acquisitions and this is something of a recurring theme.

- 2017 (€6.1 billion loss): This loss (in Euros as Vodafone changed its reporting currency in 2017) was again tied to acquisition-related tax impairments in Luxembourg and also in India, as Vodafone India merged with Idea Cellular.

- 2019 (€7.6 billion loss): This loss was also driven by acquired goodwill impairments in Spain and Romania and further impairments following the disposal of Vodafone India.

- 2020 (€0.5 billion loss): Once again, this loss was mostly caused by goodwill impairments in Spain, Ireland and Romania as well as the value of Vodafone’s stake in Vodafone Idea being written down to zero.

In summary, most of Vodafone's losses over the last ten years were driven by reductions in acquired goodwill and reductions in deferred tax assets, both of which relate to past acquisitions.

If you're not familiar with impairments and acquired goodwill, here's a brief overview: Goodwill Impairment Accounting (Corporate Finance Institute)

Currently, Vodafone is carrying €28 billion of goodwill. That’s a lot, but the cost of that goodwill (excluding all the impairments that have been deducted over the years) was €97 billion, which means that Vodafone has spent an awful lot of money acquiring other companies during its lifetime.

And that is indeed the case. In fact, the internationally diverse Vodafone of today was largely built through a series of mergers and acquisitions in the 1990s.

The late 1990s was the era of the technology, telecoms and media (TMT or dot-com) bubble and Vodafone's share price and the share price of other telecom companies were extremely high. With “perfect” timing, Vodafone made the largest acquisition in history, right at the peak of the bubble, paying £112 billion for the owner of Germany’s largest mobile network. This left an enormous goodwill asset on Vodafone's balance sheet.

Vodafone’s acquisitive history is relevant to the sustainability of its dividend in two ways:

(1) Acquisition-built companies are often fragile

Vodafone was built through mergers and acquisitions (M&A), and companies built through M&A are often complex, incohesive and fragile.

Why? Because building a company by bolting together entirely separate businesses is a bit like building a car by bolting together the engine, chassis and bodywork from three entirely different cars. It can be done, but unless you really know what you’re doing, the end result is likely to be more of a Frankenstein than a Rolls-Royce.

This is worth bearing in mind because a fragile foundation is not what you're looking for when you're after sustainable dividends and growth.

(2) Vodafone's recent losses have had little impact on its ability to pay dividends

Vodafone probably overpaid for many of its bubble-era acquisitions, leading to an excess of goodwill on the balance sheet that has consistently been written down as the post-acquisition reality failed to live up to management’s pre-acquisition dreams.

The good news is that although goodwill write-downs do represent a real loss for shareholders, they don't reduce cash or the company’s ability to pay dividends. This is why Vodafone’s dividend has remained stubbornly unsuspended throughout the last ten years, despite repeated losses.

These losses are, in other words, misleading if you're primarily interested in whether or not Vodafone's dividend is sustainable.

Fortunately, we can get a better view of Vodafone’s operational performance by looking at its adjusted earnings. Adjusted earnings strip out non-cash one-off expenses like goodwill impairments, and the idea is that they should give investors a clearer picture of the company’s underlying performance.

As a general rule, I don't like to use adjusted earnings because they usually give an excessively rose-tinted view of a company's performance. However, in this specific case, I think that looking at adjusted earnings is the right choice.

Adjusted earnings have failed to cover Vodafone's dividend

Data source: SharePad

The chart above shows Vodafone's adjusted earnings and they do make the company's results look better. The huge losses of the last decade have disappeared and that is what I’d expect to see, given that adjusted earnings almost always show a company’s performance in the best possible light.

However, the overall picture is still grim.

The chart shows that adjusted earnings still failed to cover Vodafone's dividend most of the time over the last decade. Because of that, total dividends paid over the last ten years exceeded the company’s total adjusted earnings.

When dividends are consistently uncovered, the cash used to pay those dividends has to come from somewhere. In most cases, cash is raised by taking on additional debt or by selling off parts of the company, neither of which is sustainable over the long term.

So, even if we view Vodafone through rose-tinted glasses by using adjusted earnings, its dividend has still mostly been uncovered and that is a serious Red Flag.

One consequence of an uncovered dividend is that it becomes much more likely that the dividend will be cut, rather than increased, and that is exactly what Vodafone has done on more than one occasion.

Vodafone has failed to grow its dividend over the last ten years

Related: How to identify stocks with high-quality dividend growth

Sustainable dividend growth is of course what most dividend investors are looking for, but dividends don't exist in a vacuum. Over the longer term:

- Dividend growth won’t be sustainable unless earnings are growing

- Earnings growth won’t be sustainable unless revenues are growing

- Revenues growth won’t be sustainable unless the company’s assets are growing

- Asset growth won’t be sustainable unless shareholder equity is growing

The previous chart showed that Vodafone’s equity, revenues, earnings and dividends have all fallen over the last decade, and this is not what you should expect to see from a quality dividend stock. Instead, you should expect to see broad growth across these factors, at least in line with inflation.

- Rule of thumb: Only invest in a company if the ten-year growth rate across equity, revenues and dividends is above 2%

Over the last ten years, Vodafone’s dividend has been cut twice to bring it in line with the company’s falling adjusted earnings. That is bad enough, but the lack of revenue growth is just as serious. Without more cash coming into the business from customers, sustainable dividend growth will remain a distant fantasy.

Unsurprisingly, Vodafone’s negative growth over the last ten years is another Red Flag.

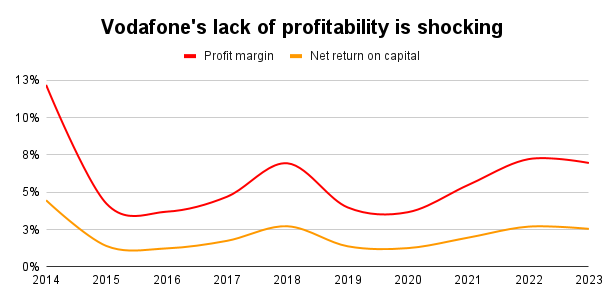

Profitability is shockingly weak

Related: Find quality dividend stocks using these profitability ratios

Companies need assets to produce products and services and those assets are typically funded by shareholders, lenders and landlords. If a company cannot produce an acceptable return on the capital provided by these stakeholders, then the company be closed down or sold off unless returns are improved within a reasonable timeframe.

The problem is that earning consistently strong returns on capital is hard because as soon as one company does it, other companies will come in and try to take those profits away.

That’s why - if I had to pick one ratio that really stands out as the hallmark of a quality company - I would pick the ten-year average of net return on capital.

Net return on capital tells us how much post-tax profit a company is making relative to the total amount of capital provided in the form of equity (by shareholders), borrowings (by lenders) and leased assets (by landlords, measured via lease liabilities).

In my experience, quality companies are able to consistently generate double-digit net returns on capital, so that is my minimum threshold.

- Rule of thumb: Only invest in a company if its ten-year net return on capital is above 10%

How does Vodafone’s profitability measure up against this rule of thumb? The answer is, not very well.

Data source: SharePad

The chart above shows Vodafone's net return on capital using the more optimistic adjusted earnings, but the company still fails to get anywhere near a return of 10% in any of the last ten years. On average, it produced a net return on capital of just 2.1%, which is shockingly bad.

You could argue that Vodafone's capital includes acquired goodwill, which reflects the potentially excessive price paid for acquisitions many years ago, so it overstates the value of Vodafone’s real-world assets and therefore understates return on capital.

That is true, but if we exclude goodwill from the calculation (almost €30 billion of it in 2023), Vodafone’s average net return on capital only improves from 2.1% to 2.8%, which is still woefully inadequate.

Vodafone's profit margins are less problematic as they exceed my minimum threshold of 5%, on average, but the company's extremely weak net returns on capital are another clear Red Flag.

In fact, this is more than just a red flag. I would say that Vodafone’s returns on capital are so consistently weak that I am almost certain that Vodafone is not a quality company or a quality dividend stock.

However, although I am now confident that Vodafone won’t be joining my UK Dividend Stocks Portfolio anytime soon, there may be a few more lessons we can draw from this company in terms of what to avoid.

Telecoms is a heavily commoditised industry with huge sunk costs

Vodafone has consistently produced terrible returns on capital, so the next question we should ask is, why?

The answer is that despite Vodafone's impressively well-known brand, almost nobody really cares if they get their mobile and internet services through Vodafone or one of its many, similarly large and capable competitors.

If there is little or no real differentiation between one service provider and another, price becomes the main point of competition. While this is usually fantastic for customers, it can be devastating for companies, like Vodafone, that find themselves selling undifferentiated commodities.

In some industries, it's relatively easy to escape commoditisation by being nimble and pivoting towards new products and new markets. However, that isn't the case in telecoms, where companies like Vodafone have tens of billions invested in physical infrastructure that cannot easily be put to use as anything other than a mobile telecoms network.

Vodafone is, in other words, stuck with an enormous base of physical infrastructure that (a) produces terrible returns, (b) is relatively fixed in terms of the services it provides and, perhaps worst of all, (c) has to be constantly upgraded just to keep up with its peers. In other words...

Vodafone is extremely capital intensive

Vodafone's mobile network has to send mobile and internet signals to almost every corner of 21 countries, and that takes a lot of physical infrastructure. Today, Vodafone has €38 billion of property, plant and equipment assets on its balance sheet.

It also has to invest a significant amount into software, so Vodafone’s balance sheet currently includes a €6 billion asset relating to computer software investments.

In an ideal world, those assets could be built, installed and then forgotten about, so that Vodafone could enjoy the fruits of its technological investments with little in the way of ongoing expenses.

But in the real world, technology is advancing at an ever-increasing pace, so Vodafone is forced to upgrade its hardware and software every few years, going from 3G to 4G and now to 5G, and very soon we’ll probably be moving on to 6G.

None of this comes free of charge. In fact, over the last ten years, Vodafone spent an incredible €92 billion maintaining, upgrading and replacing its capital assets. In comparison, it only managed to generate a total of €27 billion in adjusted earnings.

This means that on average, Vodafone's capital expenses (capex) are equal to 337% of its adjusted earnings and that is extraordinarily high. It's also way beyond my preferred limit of 100%.

- Rule of thumb: Only invest in a company if its ten-year average capex-to-earnings ratio is below 100%

Vodafone's high capital intensity is, of course, another Red Flag.

Why do I put a limit on capex? The answer is that although high capex demands aren't necessarily indicative of a low-quality company, they can make a company's cash flows less predictable while weakening the connection between earnings and cash flows.

For that reason, I prefer to invest in relatively capital unintensive businesses and, as a general rule, most quality dividend stocks do lean towards the capital-light end of the spectrum.

Another reason to avoid capital-intensive companies is that they often find themselves starved of cash because they have to reinvest so much of it back into their capital assets. This can leave them with very little in the way of spare cash, so capital-intensive businesses will sometimes compound their problems by using debt to fund their dividends and growth.

Vodafone's debts are eye-wateringly high

Related: How to avoid dividend traps with excessive debts

High debts are an obvious threat to the dividend because interest has to be paid to lenders before dividends are paid to shareholders.

As a general rule, I prefer companies to keep their debts (their combined borrowings and lease liabilities) to less than five times their ten-year average earnings. In my experience, this is enough to give companies a significant degree of flexibility in how their finance their operations, but it's restrictive enough to avoid the excessive debts that can lead to dividend cuts and suspensions.

- Rule of thumb: Only invest in a company if the ratio of debt to ten-year average earnings is below five

Here’s a snapshot of Vodafone’s debt-to-average-earnings ratio over the last decade.

Data source: SharePad

The chart shows that Vodafone’s debts are several times higher than my maximum acceptable level of five. In fact, its debt-to-average-earnings ratio has never been anywhere near five and the ten-year average is an astonishing 22.

These debts may have been affordable during the last decade of near-zero interest rates, but that may not be the case if we are heading into an era of historically normal mid-single-digit interest rates. This is a serious risk, which is why these high debts are yet another Red Flag.

Is Vodafone a quality dividend stock?

At this point, I think we've covered most of the important points, so let's pull the plug on this analysis and review the situation.

To summarise, over the last ten years Vodafone has made large reported losses, repeatedly paid an uncovered dividend, failed to grow, cut the dividend more than once, produced extremely low returns on capital, invested three times its profits back into its capital assets, much of which has been funded by an enormous debt mountain.

That is almost the polar opposite of what I would expect to see from a quality dividend stock, which is typically a company that has a long track record of relatively steady organic (non-acquisitive) growth, consistent double-digit returns on capital, a relatively capital-light business model and prudent debts.

So, the short answer is: No, I don't think Vodafone is a quality dividend stock.

Although Vodafone isn't a quality dividend stock according to my dividend investing strategy, that could change in the future.

For example, Vodafone recently hired a new CEO and she has announced a bold transformation programme, which involves the merger of Vodafone and Three in the UK and the reduction of at least 11,000 jobs over the next few years.

I hope that she succeeds in turning Vodafone around and transforming it into a truly great and enduring business, I really do.

But for now, Vodafone will be joining my blacklist of uninvestable stocks.

Are Vodafone's shares cheap or expensive at 75p?

Even though Vodafone fails to meet my standards for quality, that doesn't mean the company is worthless. In fact, many value investors deliberately invest in low-quality companies, but only if they can buy shares in those companies at bargain basement prices.

I do think Vodafone has some value, but valuing Vodafone is extremely hard because a company's intrinsic value depends upon its future dividends and the future for Vodafone's dividends is highly uncertain.

This is one reason why I try to stick with high-quality dividend stocks. Their future dividends, although still uncertain, are far more certain than the dividends of lower-quality companies, and therefore the intrinsic value of high-quality companies is much easier to estimate (although easier doesn't mean easy).

That's why I haven't tried to value Vodafone. Its current share price of 75p may or may not be cheap, but given Vodafone's lack of quality, it's a question I would rather avoid by not owning the shares in the first place.

And if I already owned shares in Vodafone? Given that the company doesn't meet my criteria, I would do the rational thing and sell the shares in order to reinvest the proceeds into higher-quality companies with dividends that were more sustainable and valuations that were more obviously attractive.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.