Domino's Pizza Group is one of the UK's highest quality dividend growth stocks and I have been a fan for many years and a shareholder for almost five years.

But increasing debts and the rise of dark kitchens have left me wondering whether Domino's is still a good investment.

Table of Contents

- Unmatched capabilities as a pizza delivery business

- Consistently good growth and profitability

- Domino's Debts have increased significantly in recent years

- Long leases are a ball and chain around Domino’s feet

- The threat from dark kitchens

- Estimating Domino's fair value

- Selling Domino's after four and a half years

Unmatched capabilities as a pizza delivery business

Let's start with some positives. I still think Domino’s is a great business. It’s heavily focused on pizza delivery and has done pretty much nothing but pizza delivery for almost 40 years.

So the business has a huge amount of knowledge built up over decades as a franchisor (and as part of the global Domino's franchise).

It's also heavily invested in super-efficient infrastructure (from giant supply chain centres that manufacture dough and other ingredients to apps that take orders, restaurants that bake pizzas and delivery drivers and riders that deliver them) as part of its vertically integrated business model.

This combination of deep expertise and well-invested infrastructure has left Domino’s as the clear market leader in the UK, with the number one pizza brand and one of the best net promoter scores (a measure of customer satisfaction) in the industry.

Consistently good growth and profitability

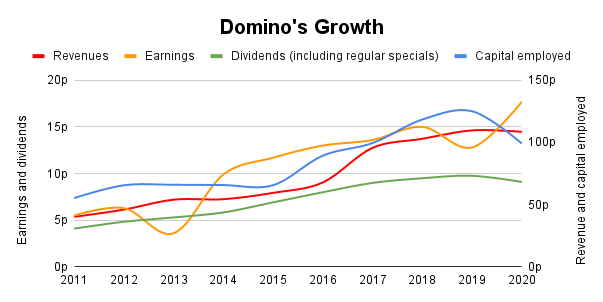

Of course, having the most popular brand is worthless if it doesn’t help the business grow, and on that front Domino’s has been fairly impressive.

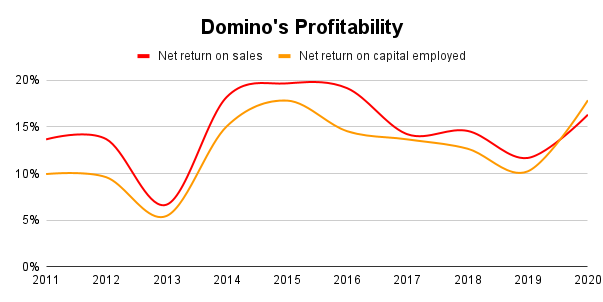

As well as impressive levels of growth, Domino’s has a long track record of impressive profitability in terms of return on both capital and sales.

Domino’s generated an average net return on capital employed (you can think of capital employed as being the stores, supply chain centres, machinery and so on, that have been funded by shareholders, banks and landlords) of around 13% over the last decade, which is comfortably above the 10% return generated by the average FTSE company.

This high return on capital is a sign that Domino’s has some sort of durable competitive advantage which helps it to consistently generate above-average profits.

In my opinion, Domino’s most important and durable competitive advantages are its market-leading brand and its position as the UK’s largest pizza delivery business.

The brand helps Domino's push up prices while reducing the need for expensive marketing, while the size of the business helps it reduce costs through economies of scale.

Okay, so up to this point I've been very positive because I think Domino's is a high-quality dividend growth stock.

But that doesn't mean it's completely trouble-free.

Domino's Debts have increased significantly in recent years

As recently as 2015, Domino’s had almost no borrowings, but by 2019 they'd grown to more than £250 million. That figure has now reduced to just over £230 million, but that’s still a lot for a company with average earnings of £50 million over the last ten years.

So why did management load the company up with debt so quickly? There are several reasons:

Organic investment: Some of the debt (around £40 million) was used to build a new supply chain centre in Warrington. This is entirely reasonable because management has to invest in Domino’s vertically integrated supply chain if the business is to grow.

Acquisitions: Some of the debt (around £80 million) was used to fund international expansion. Between 2016 and 2018, Domino’s acquired part or whole-ownership of Domino’s franchises and other pizza businesses in Switzerland, Germany, Norway, Sweden and Iceland.

In the end, these investments turned out to be an almost complete waste of time and money, as most of the acquired businesses failed to perform and have since been sold for significantly less than their purchase price.

Share buybacks: Management also launched a major share buyback scheme, returning around £130 million to investors. This occurred when debts were increasing, so some of those debts were effectively used to buy back shares.

I am not a fan of debt-funded buybacks, so I think this was a fairly serious mistake.

Overall then, Domino's has quite a lot of borrowed debt, but not a huge amount. The problem is, borrowings only make up about half of Domino’s total debts. The rest is in the form of lease liabilities.

Although Domino’s is primarily a pizza delivery business, it still has physical stores where it takes orders and makes pizzas. It even has some good old fashioned eat-in restaurants.

These are leased from landlords and, as far as I’m concerned, leases are just as much a form of debt as a loan from a bank. With a loan you borrow money and with a lease you borrow property, but in both cases, you have to pay a certain amount over a certain period, so the impact on cash flows is more or less the same.

Domino's has total lease liabilities of £304 million, or £220 million if we use the figure from the latest balance sheet (the balance sheet figure is lower because it records the of future rent liabilities rather than their nominal value of £304 million).

Add those lease liabilities to its borrowings and you get total debts of around £450 million, which is almost nine times Domino's average earnings. That’s almost twice the amount I'd call prudent, so on that basis, I think Domino’s debts are dangerously large.

But that’s only half the problem. The real danger with lease liabilities is their length.

If a lease is short (less than five years), as is typically the case with clothing and homewares retailer Next (which I wrote about last year), the rent is higher, but that higher rent buys you flexibility.

With an average lease length of 5.5 years, Next can quickly close stores with weak profits or improve their profits by re-negotiating rents downward (rents on renewed leases were almost 60% lower in 2021 as high streets continue to turn into ghost towns). All this means Next can rapidly evolve its store base in the face of disruptive online competitors.

But Domino’s leases aren’t short. They’re long. Typically 10 to 25 years long. Looking at its lease obligations, I’d say its average lease was around 13 years. That’s 13 years of being locked into an expensive eat-in restaurant or a high street store, probably with rent increases on an inflation-plus X% basis.

If Domino's operated in a stable industry that wasn't being disrupted then long leases would make sense because they offer cheaper rent.

But the delivered takeaway market is anything but stable and the process of digital disruption is already well underway.

Over the last few years, the delivered takeaway market has been disrupted by Just Eat, Deliveroo and others.

These companies aggregate restaurants and customers onto their platform, making it easier for customers to find restaurants that deliver and for restaurants that deliver to find customers who want a delivered takeaway.

These are "network effect" businesses where scale is everything. The platform with the most restaurants attracts the most customers, and the platform with the most customers attracts the most restaurants.

Once you’re the biggest aggregator, you’re almost impossible to beat (as is the case with Facebook, Rightmove, Amazon and others).

Although these aggregators can’t seriously compete against Domino’s when it comes to delivered pizza, they can offer customers an incredible amount of choice and convenience that simply didn’t exist a decade ago.

So instead of potential customers weighing the pros and cons of Domino's versus a delivered kebab or Chinese meal, customers can now choose between Domino's and literally dozens of big brands and local restaurants with super-quick delivery times.

As a result of all this added competition, Domino’s market share is shrinking. But the aggregators spend huge sums on advertising and that increases the size of the overall delivered takeaway market. So far, Domino's growing market and shrinking market share have more or less balanced each other out, but that may be about to change with the rise of dark kitchens.

Dark kitchens are kitchens optimised for the delivered takeaway market, which means they’re optimised for low cost and short delivery times.

Dark kitchens are very low cost: To keep costs as low as possible, dark kitchens are located where rents are materially lower than typical restaurant locations. Some are located on industrial estates while others are in disused car parks, under railway bridges or on wasteland.

The second step to keeping costs low is to use converted shipping containers or portacabins instead of brick buildings. These can be brought in on the back of a truck and hooked up to gas and electricity at a fraction of the cost of fitting out (let alone building) an attractive customer-facing store.

Dark kitchens have very short delivery times: Having a short delivery time is important, so dark kitchens are typically placed near residential areas or business parks, where thousands of hungry customers can be reached within 15 minutes. If the most efficient location is at the far end of a railway car park, that’s where the dark kitchen will go.

Domino’s, with its nicely decorated high street stores, simply has no way of competing with dark kitchens on cost or convenience grounds (and the same goes for pretty much any urban or suburban restaurant).

Just to reiterate: Deliveroo or Just Eat can't beat Domino’s when it comes to pizza, but they will be able to offer a wider range of quality food at lower cost and with shorter delivery times thanks to their increasing use of dark kitchens.

Of course, Domino’s could fight back with its own dark kitchens and I think that’s very likely in the next few years. But Domino’s long leases reduce its agility and it's unclear how Domino's already-strained relationship with franchisees would cope with a shift towards dark kitchens.

And I haven’t even mentioned the next wave of disruption, which could come from businesses like connects hungry customers with local home-based cooks.

If you thought dark kitchens were cheap to set up and close to the customer, how about a kitchen that has almost no setup costs (because it's in someone's house) and could be quite literally next door to the customer?

If this sort of thing becomes popular, as I think it might once people get used to the idea, then it would increase the amount of choice in the delivered takeaway market by a factor of ten, at the very least.

I have no doubt that Domino’s winning combination of brand, efficiency, quality and consistency will always be hard to beat, but if pizza is just one delivered takeaway option among hundreds, I think Domino’s is likely to find the next 20 years much harder going than the last 20.

Estimating Domino's fair value

The intrinsic value of a company depends entirely on the cash it will return to shareholders over its remaining lifetime, so any estimate of fair value must take into account the variety of factors that will impact its future dividends.

For most companies, those key factors are:

- The potential for growth within existing core markets, both now and in the future

- The potential for expansion into adjacent markets

- The company's expected return on capital employed

- The level of returns reinvested in the business to drive growth

For Domino's, I've estimated its future dividends and fair value using the following assumptions:

- UK and Ireland stores grow from 1,200 to 1,400 within five years and 1,600 within ten years (in line with management targets)

- UK and Ireland "System sales” grows to £1.9 billion within five years (in line with management targets)

- No international growth (in line with previous failure to grow internationally)

- Earnings per store grow slightly ahead of inflation (in line with historical trends)

- Returns on capital average 18% (ahead of the historical average after the recent removal of weak international businesses)

- Dividend cover averages 1.7 (which allows for progressive dividend growth while retaining enough earnings to fund expansion in line with the preceding assumptions)

- A long-term growth rate of 3.5% once the UK market is fully saturated (around 2030)

In other words, because of the risk from dark kitchens, I'm not going to be more optimistic than management's own targets and I'm not going to assume a high long-term growth rate.

With the aid of my trusty investment spreadsheet, those assumptions give the following results:

- Earnings per share grow from 18p in 2020 to almost 28p in 2029

- Dividends per share grow from 9.1p in 2020 to 16.2p in 2029

- Dividends grow at 3.5% "forever", after 2029

Obviously these estimates will be wrong, but I'm not looking for perfect foresight. What I'm after is a realistic and conservative estimate of the future, and I think the above estimates meet that description.

I'm assuming that Domino's can hit its management targets, but no more. That would grow the business by more than 50% over the next decade, which is pretty good going for a business that is approaching saturation in its core market.

Putting those dividend growth estimates into a discounted dividend model gives the following results for Domino's:

- "Fair value" (7% expected rate of return) = £3.64

- "Good value" (10% expected rate of return) = £2.04

At the time of writing, Domino's share price is £3.85, so it's trading above my estimate of fair value.

That means its "expected rate of return" is below 7%, where 7% is the long-run average return of the UK stock market.

This expectation of below market returns is why I've removed Domino's from the UK Dividend Stocks Portfolio and my personal portfolio.

Selling Domino's after four and a half years

I originally invested in Domino's in 2017, with an initial purchase price of £2.76.

Over the next four years and six months, the investment produced the following results:

-

Capital gains of 22.7%

-

Dividends totalling 9.5%

-

Total returns of 32.2%

-

Annualised returns of 8.8%

At a bare minimum, I'm looking to beat the FTSE All-Share's long-term average returns, which are something like a 3% yield and a 7% total annualised return. Domino's produced returns that were slightly ahead of both of those targets, so on that basis, this was a successful investment.

However, I’m ideally aiming for at least a 5% dividend yield and annualised total returns of 10%, and this investment fell slightly behind those targets.

But I'm not overly disappointed. Domino's is a high-quality dividend growth stock, it produced a decent yield and progressive dividend growth and the capital gains weren't too bad.

So it was a reasonably good investment, but the combination of a materially higher share price and potentially weakening prospects make Domino's a less attractive proposition today, at least to my eyes.

The proceeds from the sale have, as usual, been reinvested into one of my portfolio's most attractive and highest-yielding holdings.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.