For reasons that escape me, UK financial stocks are massively out of favour.

For example, Admiral, one of the UK's largest motor insurers, has a dividend yield of 7.5% at its current share price of £25.

That kind of yield is usually reserved for cigar butts and basket cases, so does that describe Admiral, or is the market materially undervaluing this business?

Table of Contents

- Admiral’s financial track record is exceptional

- Does Admiral have any durable competitive advantages?

- Is Admiral’s share price cheap, fair or expensive?

- A simple model of Admiral’s future dividends

- Valuing Admiral using a discounted dividend model

- Does Admiral deserve its 7.5% dividend yield?

Admiral’s financial track record is exceptional

As usual, I'll start with the numbers, because high-quality companies leave a recognisable footprint in their financial past, with the most obvious being a long and consistent track record of growth, so let’s begin there.

Few high-yield stocks can match Admiral's track record of growth

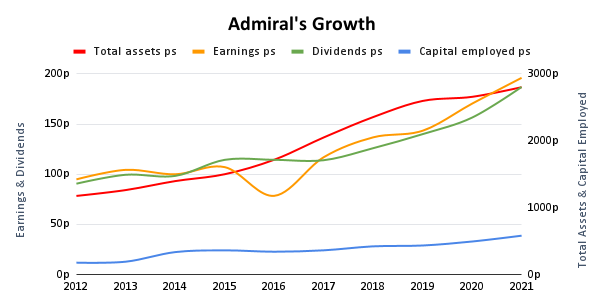

Admiral is an insurance business, so I'm looking for a consistent track record of growth across total assets (mostly insurance premiums held on the balance sheet to cover the cost of future claims), capital employed (effectively debt plus shareholder equity), earnings and dividends, and Admiral delivers that by the bucket load.

Over the last ten years, Admiral has consistently delivered growth of around 10% per year, so despite the high yield, this company is no declining or sluggish has-been and it easily beats my rule of thumb for growth:

- Rule of thumb: Only invest in companies that have grown ahead of inflation over the last ten years

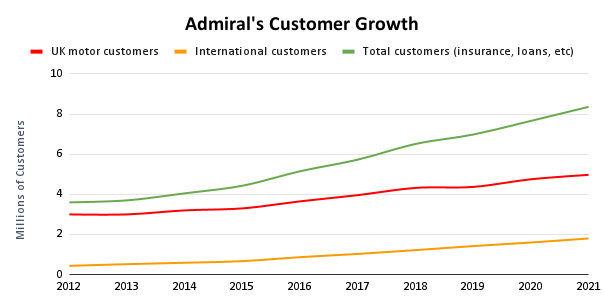

Looking underneath the financials, most of this growth has come through the addition of new customers, with the company's total customer base growing by around 10% per year over the same ten-year period.

Over the period, UK motor insurance customers grew by about 6% per year. This is slower than the company's overall customer growth rate, and the difference is down to Admiral's successful expansion into markets outside of UK motor insurance.

But before we get into that, let's have a look at Admiral's profitability, because a track record of consistently high profitability is a key feature of high-quality companies.

Admiral's profitability is exceptional by almost any standards

For me, the single most important metric is net return on capital employed (net ROCE).

If a company can produce abnormally high post-tax profits from its fixed capital and working capital over many years and preferably decades, it probably has some enduring competitive advantages.

Why? Because if it didn't have durable competitive advantages, copycat competitors would have driven down prices and profits.

And once again, Admiral doesn't disappoint.

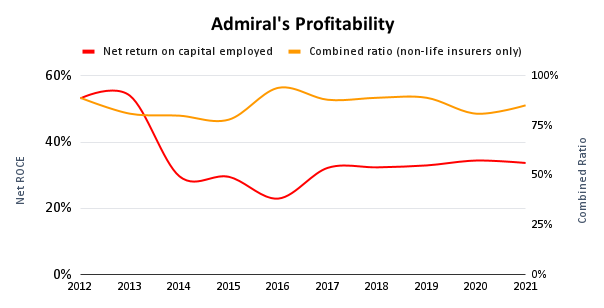

Admiral's net return on capital has been consistently above 30% for most of the last decade. That's far above the 10% produced by the average FTSE 100 company and it's far above my profitability rule of thumb:

- Rule of thumb: Only invest in companies where net return on capital employed is consistently above 10%

The chart above shows an abrupt decline in return on capital between 2013 and 2014. That occurred because Admiral took on £200 million of subordinated debt to strengthen its capital buffer.

This buffer is held on the balance sheet of insurers and banks so they can still pay out policyholder claims or customer deposits in the event of bankruptcy.

Even with this debt in place, Admiral's debts total less than a single year’s average profit. That’s well below my rule of thumb for debt:

- Rule of thumb: Only invest in companies where total debt (including lease liabilities) is less than five times average profits

The chart above also shows Admiral's combined ratio, which is effectively the profit margin of an insurer's underwriting (insurance) operations.

Somewhat annoyingly, the combined ratio is an inverse profit margin, so a value of 99% is a margin of 1%, 90% is a margin of 10% and so on.

For "normal" companies my rule of thumb is that profit margins should be consistently above 5%, and that applies to insurers too:

- Rule of thumb: Only invest in insurers where the combined ratio is consistently below 95%

Admiral's average combined ratio is 85%, which is extraordinarily low given that car insurance is effectively a commoditised product with little to differentiate one policy from the next.

So Admiral’s financial track record is extremely impressive, with high profits fuelling growth that has allowed the company to more than double in size over the last decade.

This is all good news, but are these results down to luck or…

Does Admiral have any durable competitive advantages?

If a company can produce exceptional profits and growth over multiple decades, it almost definitely isn’t down to luck. Instead, it probably has durable competitive advantages that enable it to beat the competition, year after year after year.

In Admiral’s case, I think it has one primary advantage that is extremely hard for competitors to replicate and one secondary advantage that is powerful but perhaps easier to replicate (although as far as I know, none of Admiral’s peers have tried to replicate it yet).

Competitive advantage #1: Admiral is a family business

Now, Admiral isn’t literally a family business, but it does operate along similar lines to many highly successful multi-generational family businesses.

What do successful multi-generational family businesses usually do? This isn’t an exhaustive list, but in general they:

- Take culture seriously, because leaders come and go, but a strong culture can endure for generations

- Take succession seriously, by developing a deep pool of talent within the next generation, moving them around within the business over many years

- Focus on long-term growth, because the current generation’s main task is to pass on a thriving business to the next generation 10, 20 or 30 years from now

- Are very robust, with deliberately diverse operations and cast iron balance sheets, so short-term crises don’t threaten the long-term survival of the firm

- Don’t bet the farm, so they don’t make mega-acquisitions and they don’t bet the company’s future on a single hot technology or market

I’ll cover each of those points briefly.

Culture and succession: Admiral was run by its co-founders from 1993 to 2020, so they had plenty of time to build an enduring “family business” culture.

The new CEO, Milena Mondini de Focatiis, has already been at Admiral since 2007. That’s good because handing the CEO role to an internal candidate with 14 years of experience in the business is exactly what many successful family businesses would do.

Long-term focus: If a company is willing to invest in a new venture that is in the long-term interests of the business but will take a decade or two before it even makes a profit, there’s a good chance that the company has a “family business” culture.

In Admiral’s case, this shows up in its international insurance businesses in Italy, Spain, France and the US. These businesses have been building scale for over a decade and yet, as a group, they still don’t consistently generate a profit.

But this isn’t simply a case of refusing to accept that the venture was a bad idea in the first place. No; these businesses are growing rapidly, with total international customers doubling over the last five years and growing at a rate of 17% per year over the last decade to almost two million customers today.

This increasing scale has enabled the international business's combined ratio to fall from 168% in 2012 to 108% in 2020. When it falls below 100%, Admiral’s international businesses will begin to consistently generate profits and that would be a powerful source of additional profits for the next decade and beyond.

In my experience, few "outside" CEOs would be willing to lose money on a venture for a decade in pursuit of excellent long-term profits. That's because most CEOs are only in place for about five years, so the next five years are all most of them care about.

Robustness: In my experience, insurers run into problems because they don't price risks accurately, they invest reserved premiums in assets that are too risky, or they're too concentrated on too few types of insurance.

Admiral is well-positioned to avoid these most obvious errors, as its insurance operations are extremely profitable (implying that it has good risk-pricing capabilities), its reserved premiums are invested in super-low-risk assets and it's deliberately diversifying away from UK motor insurance and into international insurance, home insurance and loans.

Not betting the farm: Admiral’s approach to business is what it calls “test and learn”, which means it tries out lots of small things and backs the winners. This applies to the evolution of the core UK motor insurance business, but it also applies to Admiral’s expansion into closely related adjacent markets.

So instead of acquiring a large Italian car insurance business or UK personal loans business, Admiral builds these businesses from scratch. That allows it to choose all the staff and all the technology, and it can embed the “Admiral Way” into the new business from day one.

These businesses then have to struggle through the start-up and scale-up phases, and that gives Admiral a rich source of lessons it can then apply to future ventures.

Admiral has now more formally encapsulated this approach into its Admiral Pioneers program, which is effectively Admiral's start-up incubator.

Competitive advantage #2: Admiral is the lowest-cost operator

Although operating like a successful multi-generational family business is helpful, a company still needs a durable competitive advantage if it’s going to be more profitable than its peers over multiple decades.

In Admiral's case, it has the advantage of being the lowest-cost operator in the UK. That's because it's able to consistently acquire, insure and service customers more efficiently than its peers.

Acquire customers more efficiently: In the early years, Admiral was able to acquire customers more cheaply than most of its peers by acquiring them directly through the Yellow Pages rather than through an insurance broker (Admiral is called Admiral because the Yellow Pages showed companies alphabetically).

By the early 2000s, lots of other direct insurers had sprung up and they started acquiring customers through price comparison websites (PCWs) rather than the Yellow Pages. So Admiral took the bold but ultimately ingenious step of launching its own price comparison website, confused.com (built from scratch, rather than acquired).

By operating its own PCW, Admiral recovered any commissions paid to confused.com and, more importantly, the PCW became a source of profit rather than just an expense.

This setup worked well for 20 years, but in 2020 Admiral had grown to the point where confused.com and Admiral's international PCWs were less relevant, so it bundled them together as Penguin Portals and sold the lot for a £460 million profit. Around £400 million of that profit is being returned to shareholders through special dividends.

Insure customers more efficiently: In some ways, Admiral is more of an insurance broker than an insurer. That’s because it offloads most of its policies onto co-insurance and reinsurance partners, who cover the related cost of claims as they arise.

For example, in its UK motor insurance business, Admiral currently retains 22% of the premiums and associated risks, with the rest being handled by insurance partners.

This setup enables Admiral to insure drivers very efficiently because insurance is all about scale, and Munich Re, Admiral’s largest insurance partner and a major shareholder, is about 50 times bigger than Admiral.

So Admiral can offer customers attractively low premiums because it’s largely a broker for Munich Re and other mega-sized co-insurers and reinsurers.

Admiral also keeps costs low by keeping its employees happy. Happy employees are more likely to stick around rather than leave just because another job offers a fractionally higher wage. That means lower wage costs, lower recruitment costs and more experienced staff who are more productive and have the Admiral Way more deeply ingrained into their DNA.

That’s why Admiral has a Ministry of Fun and it’s why the company has won more “Best Place to Work” awards than you can shake a stick at.

Service customers more efficiently: From the customer's point of view, the only time an insurance company provides a meaningful service is when they have to handle a claim. This is by far the most important touch-point with customers, as a well-handled claim can massively influence the odds that the customer will renew with the same insurer.

Admiral ticks this box by following the “happy employees = happy customers” idea. In other words, Admiral has claims staff who have been with the company for a long time because they’re happy, so they’re experienced and they’ve handled a wide variety of claims and claimants.

And because these employees are happy, they’re more likely to treat customers well rather than act like grumpy teenagers who'd really rather be somewhere else.

Last but not least, having the whole UK business operate from Wales doesn’t hurt, because real estate and wage costs there are materially lower than they are in England, where many of its peers have their offices.

Of course, all motor insurers are trying to acquire, insure and service customers cost-effectively, but Admiral seems to consistently do it better than just about every other UK motor insurer.

Is Admiral’s share price cheap, fair or expensive?

To answer this question, we need to think about Admiral’s ability to pay dividends over the long term. That’s because a company’s intrinsic value is derived solely from the cash it will pay out to investors over its remaining lifetime.

So the first thing we need to do is estimate Admiral’s future dividends in order to estimate its intrinsic or fair value, and then we can compare that to its actual share price to see if its shares are overpriced or undervalued.

A simple model of Admiral’s future dividends

This blog post is already quite long so I won’t go into every detail, but here are a few of the main points worth considering:

(1) Core UK motor insurance growth

The UK motor insurance market is expected to grow for at least the next couple of decades. That expectation is based on a few factors, mainly that (1) the total number of miles driven (and therefore the number of accidents) is likely to remain broadly flat and (2) the cost of repairing cars is expected to increase ahead of inflation as cars become ever-more covered in expensive-to-repair sensors.

This combination alone should be enough to allow low to mid-single-digit growth in UK motor insurance over at least the next decade.

(2) International insurance growth

In addition to the UK market, Admiral has significant insurance businesses in Italy, Spain, France and the US, and after more than a decade of scaling up, these businesses are on the brink of producing consistent and potentially fast-growing profits.

Taking a more negative view, there is a risk that at some point cars will drive autonomously and insurance will be organised by the manufacturer rather than the "driver", as the "driver" will probably be asleep in the back of the car when the accident happens.

Personally, I doubt this technology will be widespread within 20 years. And when we do reach that point, cars will still need insurance, so Admiral has plenty of time to build a manufacturer-focused insurance business. In fact, this process has already begun and Admiral already operates Ford Insure.

(3) Growth beyond motor insurance

To further reduce the risks posed by autonomous cars, Admiral has started to expand beyond motor insurance. Admiral Home Insurance has been growing for many years and the company is diversifying into other lines of insurance with the help of Admiral Pioneers.

It’s also expanding outside insurance, with the most obvious and successful example being Admiral Loans.

Long-term mid-single-digit growth should be possible

Taking all of that into account, I think Admiral should be able to grow at mid-single-digit rates for at least the next decade, and probably much longer.

There are short-term headwinds though, with the obvious ones being inflation and Russia’s attack on Ukraine. So far it isn’t obvious how these would impact a car insurer, so I’ve ignored them for now.

If they do begin to have a material impact then my assumptions and dividend model will need updating, but that isn't a problem because updating your assumptions and models is a normal part of being an active investor.

Of course, Admiral's growth won't happen by magic. To write more policies Admiral will need more people, more computers and a larger capital buffer, and that takes money.

Fortunately, Admiral has plenty of money. With a return on capital of more than 30%, it can afford to fund a growth rate of more than 4% per year while only retaining a fraction of its earnings. The rest can be paid out as a sustainable and progressive dividend.

If I plug those figures into my investment spreadsheet, I get a 2022 basic dividend of 152p, which swells to 198p when I include the expected 46p special dividend from the sale of Penguin Portals. That dividend then grows to 215p by 2030. After that, it grows by 4.3% per year "forever".

Here's a snapshot of the model from my spreadsheet:

Now that we have an estimate of Admiral’s future dividends, we can easily estimate its fair value.

Valuing Admiral using a discounted dividend model

In very simple terms, a discounted dividend model takes into account the fact that most people would rather have £1,000 given to them today than in ten years. In other words, £1,000 today is worth more than £1,000 in ten years, so we instinctively discount (reduce) the present value of future cash flows.

Because a company is worth the sum of all the cash it will ever return to shareholders, we need to calculate the present value of those future dividends and sum them up to arrive at a fair or intrinsic value for the company.

To calculate the present value of future dividends, we can use our preferred rate of return. If we want the average UK market return of about 7% per year, we can use that as our discount rate.

- Applying a 7% discount rate to the estimated dividends from the table above, we end up with a fair value for Admiral of £54.87.

At that price, the company would have a dividend yield of 2.9% (ignoring the special dividends from Pengiun Portals) and that's about average for a company growing at mid-single-digit rates.

- My actual target return is 10% and if I use that as the discount rate then we get a “good value” estimate for Admiral of £26.14.

In other words, if Admiral was trading at £26 then under most circumstances I’d expect it to produce a return of around 10% per year over the long term.

Admiral is currently trading at £25, so at today’s price, I would expect Admiral to return slightly more than 10% per year, on average and under most circumstances.

Of course, the future isn’t guaranteed and if there’s a nuclear war then Admiral probably wouldn't produce 10% annualised returns. But under most reasonable circumstances, I would expect that sort of return at today's price.

Does Admiral deserve its 7.5% dividend yield?

So, let's return to the premise of this blog post: Does Admiral deserve such a high yield?

In other words, is Admiral likely to either grow very slowly over the next decade or not at all or is a dividend cut imminent? Or, alternatively, is the market seriously undervaluing this business?

Obviously, I think Admiral is materially underpriced.

At today’s £25 price, I would be happy to buy shares in Admiral and, in fact, Admiral has already been in the UK Dividend Stocks Portfolio since 2013.

I opened the position at £13 and it's already paid enough dividends to cover the original investment. I recently topped it up at £30 per share, and at today’s price, I’d happily top it up again if necessary.

Overall, I think Admiral is one of the best dividend growth stocks in the UK market, and that's why it makes up more than 5% of my portfolio.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.